We’ve gathered everything you need to know about the practical side of wanderlust, providing you with all the knowledge necessary to gracefully negotiate the unexpected twists that often accompany the joys of globetrotting. Consider this your passport to a hassle-free travel experience, making the seemingly mundane world of travel insurance an indispensable ally in your quest for unforgettable adventures.

Travel insurance tips and advice

Did you know that a boozy night might void your claim? Or a medical condition could up your premiums? The world of travel insurance isn’t always straightforward – so exploring the ins and outs of why you need it, how not to void it, and how to navigate the fine print will prepare you for a relaxing holiday – sans financial ruin. You probably also want to know how to save money on insurance, and what you’ll want from your insurer if things go wrong. We’ve got you covered on all fronts, so you can focus on the fun part.

Travel insurance guides

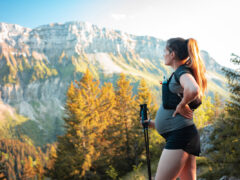

Navigating the world of travel insurance is like wandering into a busy restaurant, full of options ranging from the all-you-can-eat-buffet to the exclusive a la carte menu. Perhaps your credit card already offers sufficient insurance, or you fancy a bit of shopping around to find the perfect fit for your unique needs. Heads up – standard policies won’t carve through the snowy ski slopes; you’ll need a special winter sports policy for that. Cruising? That also calls for its own coverage. You’ll be pleased to know that you’re good to travel under your basic insurance policy when you’re pregnant – but only to a certain point in time, and not if you’ve conceived using IVF. Don’t hide those pre-existing medical conditions – our guide on finding the right insurance with them has got your back. We’ve done all the research, so you don’t have to.

Common insurance questions answered

We get it – you’re itching to switch into travel mode. Googling the ins and outs of travel insurance for hours? Not on your agenda. Your focus is crafting the perfect itinerary, snagging the ideal accommodation, and packing your bags – the fun stuff! We’re here to make the travel insurance maze a breeze. So, these are the burning questions that you, our readers, have been sending our way. The only thing you’ll be diving into is how to enjoy the trip of a lifetime, not stressing over insurance jargon. Keep reading; we’ve got your curiosity covered.